Agriculture in Poland

Current data:

In 2013, in relation to the previous year, gross agricultural output increased by 3,7%. The growth in global production was the result of increased crop production (by 5,0%), as well as livestock production (by 2,1%). The level of livestock production resulted from the increase in the production of live poultry, chicken eggs and cow milk. The significant increase in prices occurred on the market of milk and eggs at the same time.

General characteristics

Polish agriculture is characterized by significant fragmentation – the average area of agricultural land per farm is gradually increasing, and in 2013 it amounted to 10.2 ha.Over a half of farms produce mainly or exclusively for their own use, thus limiting their expenses on food and family maintenance. Such farms of a relatively small area employ traditional production methods, i.e. a limited use of mineral fertilizers and chemical plant pesticides, as well as industrial fodder in feeding farm animals, especially cattle.

Despite this phenomenon and the prevalence of soils of low usefulness for agriculture, Poland is an important European and global producerof agricultural and horticultural products, as well as of animal products.

Place of the Polish agriculture in EU-27 in 2012

This proves the diversity of polish agricultural structure - being an important agricultural and food producer is possible because, next to small family farms, Poland also has a lot of big, highly specialised and excellently developed farms.

Poland also holds a leading position in the productionof berries (strawberries, raspberries andcurrants) and outdoor grown vegetables, such as: onion, cabbage and cauliflower.

Soil and climatic conditions, as well as regional traditions, determine the kind of production a given farm specializes in.

In central, eastern and northern Poland, potatoes, rye and grass land prevail. Orchards and berry plantations are located mainly in Mazowieckie Voivodship (region of Grójec), in Lubelskie Voivodeship, in Sandomierz region and in Wielkopolskie and Łódzkie Voivodeships. Cultivation of plants with higher soiland climatic requirements is concentrated in the south-eastern and western parts of the country, as well as in Żuławy and Warmia (north-central Poland) i.e. intensive cereals, mainly wheat, sugar beet and rape, predominatein these areas. Cattle breeding is mostly concentrated in Podlaskie, Mazowieckie, Warmińsko-Mazurskie and Wielkopolskie Voivodeships whereas the majority of pigs are bred in Wielkopolskie and Kujawsko-Pomorskie Voivodeships. Sheep breeding is more intense only in the mountainous region (Małopolskie Voivodeship).

Land resources and the structure of their utilisation

In the total area of Poland, which is 31,3 million ha, the area of agricultural land is 14,6 million ha, which constitutes 46,6% of the total area of the country. The quality of agricultural land in Poland is poor, poorer than the average in the EU. The high percentage of poor and acidified soils limits the agricultural usefulness of agricultural land. The share of lights oils, which in Poland are characterised by a high sand content, is two times higher than the EU average, and it amounts to 60,8% of agricultural land - in the EU it is 31,8%.

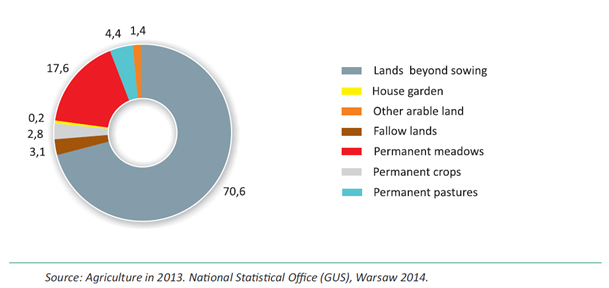

Structure of use of arable lands in 2013 (in %)

Meat market

Poland is an important meat producer in the European Union. In 2013 we held the fourth position with regard to pork production, the second in terms of production of poultry meat and was the eighth beef producer. Poland clearly records a positive balance in its international trade in meat and its by products; in 2013 it was 766,4 thousand tons and in relation to 2012 it increased by 82,6 thousand tons, i.e. o. 12,1%.

The average overall meat consumption amounts to approx. 69 kg per capita.

Beef market

For several years, the production of beef in Poland has been at a stand still, which is caused by a low consumption of this kind of meat - this to a large extent depends on the income of the population and translates into the size of cattle population.

In December 2013, the cattle population amounted to 5.595,5 thousand, showing an increase of 1,4% during the year. The increase of the overall herd of cattle resulted from the increase in the number of calves (by 2%) and in the group of adult cattle aged 1-2 and above (by 3,4%).

The shares of individual age and use groups in the overall structure of the herd of cattle in December 2013 were the following:

• calves younger than 1 year of age – 25,2%,

• young breeding and slaughter cattle aged between 24 and 48 months – 24,5%,

• adult breeding and slaughter cattle aged 2 and over – 50,3%, including:

• cows – 43,7%.

A study of cattle population carried out in December indicates an annual increase in the size of the overall herd of cattle resulting from a higher number of calves and young cattle up to 2 years old.

A stable and growing farmers’ interest in the production of beef cattle primarily results from the persistence of favourable prices (hence the increase of cattle population in the group of 1-2 years of age by 3,6%). Continuation of cows number reduction - on a scale of 2.441,7 thousand units, was mainly due to the further rationalization and concentration of milk production. The consequence of reducing the number of cows was the decline in their share in the total cattle (up to 43,7% compared to 44,7% in the previous year). Changes in the structure of herds confirmed progressive restructuring of cattle towards the production of beef cattle. Most of beef produced in Poland, due to high domestic prices, is exported (323,1 thousand tonnes in 2013), mainly to Italy and Germany.

Milk market

Milk production is one of the most important sectors of animal production in Poland. It places our country at the 4th - within EU - and at the 12th position in the world in terms of the level of milk production.

The average overall milk consumption, including dairy products, excluding milk for butter production, amounts to almost 200 l per capita.

According to Central Statistical Office (GUS) figures, the 2013 value of industrial milk production amounted to PLN 14,0 billion and accounted for over 17,3% of overall value of agricultural commodity production. The total 2013 production of milk in Poland increased by 0,4% and amounted to 12,3 billion litres, despite the prevailing falling trend in the number of dairy cows. Herd reduction by 3,3% to the number of 2,3 million units of dairy cows as in December 2013 was offset by nearly 4% increase in productivity to the level of nearly 5.350 kg. The reduction of the dairy herd was a result of decreasing number of milk producers in Poland. However, the number of dairy cows subjected to milk recording is growing – at the end of 2014, 33% of the dairy cows wasin milk recording, and the average yield of a recorded cow reached 7.582 kg of milk. Today, the population of cows in milk recording is almost 740.000.

The predominant dairy breed in Polish milk recording, invariably is the Holstein – Friesian (black-white and red-white) 90,5 % in the active population, however its % participation slightly decreased and it seems to be a steady tendency upon the last several years. But, on the other hand, this decreasing tendency is seen only in the percentage, because if we look at the figures - Holstein population grows in numbers year by year along with the increase of recorded population.

On the other hand, there is still a growing tend to be interested in breeding coloured breeds such as: Simmental, Montbeliarde and indigenous robust breeds like Red Polish (RP) – typical for the mountains, Polish Black-White (ZB), Polish Red-White (ZR) or White-back (BG) which all together with cross breeds (MM) and other breeds make 9,5% of active cattle population.The above mentioned direction shows that breeders are interested also in cattle characterized with high resistance, long evity and also tolerance of poorer nutritional conditions and more difficult environmental requirements.

Progressive concentration and specialization effects in the annual increase of industrial milk production, due to which the national wholesale quota is wholly utilized and recently has even been exceeded.

Within the quota system each Member State has a national milk quota which reflects the maximum amount of milk which may be marketed in a given quota year, i.e. between 1 April and 31 March the following year. National milk quota is divided into the national wholesale quota – including milk supplies by farmers to buying-in facilities and a national direct quota – within which farmers sell milk and milk products directly on the market. Exceeding the national wholesale quota or the national direct quota results in a fine to be paid to the EU budget.

Current legislation provides for the existence of quotas until 31 March 2015. In order to adjust the milk market to operating without quotas, the national milk quota has been increased since the quota of year 2009/2010 by 1% for the consecutive 5 years. The increase is allocated fully to the national wholesale quota.

Subsidies to the consumption of milk and milk products in school facilities

For ten years now, the Agricultural Market Agency has been implementing a “Milk at school” programme. The aim of the program is to shape healthy nutrition habits in the youth, by means of promoting the consumption of milk and milk products. The program is funded from three sources:

• EU budget, from which the supply of milk and milk products to all the school facilities concerned is funded,

• state budget from which the supply of milk and milk products to primary schools is funded, thanks to which children are provided with plain milk free of charge,

• Milk Promotion Fund, from which the supply of milk and milk products to kindergartens and middle schools is funded.

In the school year 2012/2013, 2,43 million children and pupils of 14,16 thousand schools benefited from the program.

Since Poland’s accession to the EU (2004) until the end of 2013 under “Milk at School” programme children and pupils consumed ca. 390 thousand tons of milk and its products (which corresponds to about 1.9 billion of “milk glasses”).

During this period, the Agricultural Market Agency spent over 996,3 million PLN on this initiative, of which 688,6 million PLN from EU budget, 280,8 million PLN from the state budget and 26,9 million PLN from Milk Promotion Fund. For details see the chapter on Agricultural Market Agency.

.png)